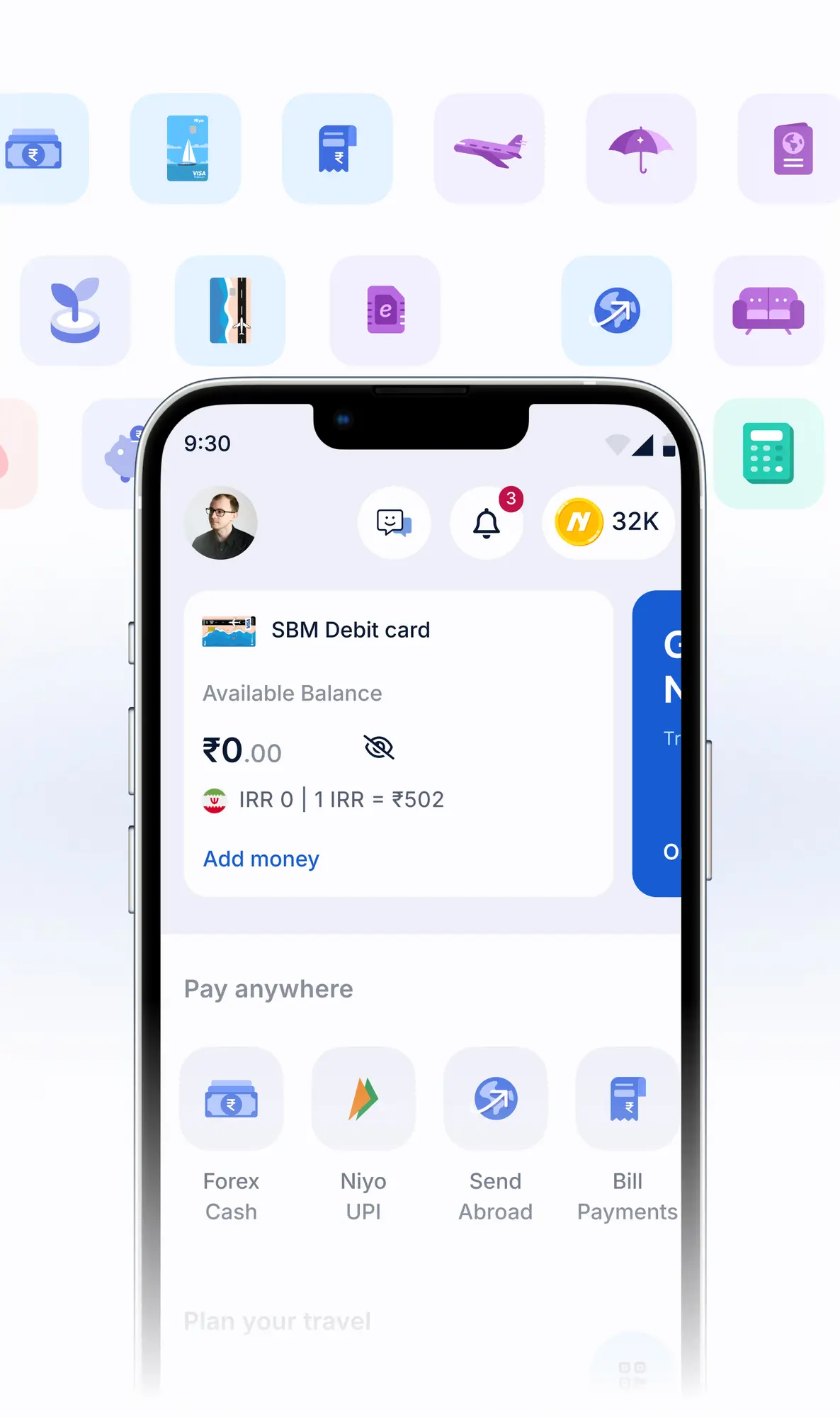

Smart Tools for Smoother Travel

India or abroad, there is a tool to solve all your problems

Cards issued by

Powered by

Deals, rewards, savings and so much more!

Earn big on referrals and travel bookings. Redeem Niyo coins to get discounts on flights and visas.

India or abroad, there is a tool to solve all your problems

Up to ₹5L per bank per user is insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC, a wholly owned subsidiary of the RBI).

Feel confident using the Niyo zero forex markup card while travelling abroad by trying it in India.

Use the in-app chat support to get real-time assistance, no matter the hour or time zone.

Certification & compliances

ISO 27001

ISO 27001 NPCI Approved

NPCI Approved ISO 20022

ISO 20022Niyo offers international payments and travel-related services:

Usually, most leading banks and service providers add a fee/markup of up to 5% for the convenience of making payments in a foreign currency. Niyo does not charge this fee (zero forex markup) and allows you to make transactions abroad at no extra cost - you save up to 5% with each transaction abroad!

The zero forex markup international debit and credit cards offered by Niyo are designed to help Indian travellers transact in foreign currency conveniently and securely at no extra charges.

All residents of India, above 18 years of age who hold a valid Indian passport are eligible to apply for a Niyo Zero Forex Markup Card.

Yes, you can secure a tourist visa from India through Niyo - it’s easy and smooth! You don’t have to reach out to the respective embassy, Niyo does it all for you.

All residents of India, above 18 years of age who hold a valid Aadhaar, PAN, and Indian passport are eligible to apply for zero forex markup cards offered by Niyo.

Niyo offers international debit and credit cards in partnership with trusted banks like DCB Bank and SBM Bank (India).

Here’s a quick comparison of zero forex markup cards offered by Niyo vs. multi-currency forex cards.

| Feature | Niyo Cards | Traditional Forex Cards |

|---|---|---|

| Card Type | Indian Rupee Debit Card, works across 130+ currencies | Forex Card |

| Forex Markup | Zero Forex Markup on VISA Exchange Rate | Up to 5% |

| Account Loading | Instantly via UPI | Up to 3 days |

| Interest | Up to 8% interest p.a.* | ❌ |

| Joining Fee | None | Activation fee applies |

| Exchange Rate | VISA exchange rate is applied to all currency conversions. Niyo doesn’t charge any fee. | Exchange rates vary across forex cards. Recommended to check with the service provider |

| Loading/Unloading Fee | None, add money 24/7 for free | Fee is charged both during loading & unloading money |

| Compatible Currencies | Just add money in INR and use it in 180+ countries to transact in 130+ currencies | 22 currencies max. |

| Zero Balance Account | No fee for not maintaining a balance in your account. | An inactivity fee is charged to keep your card active |

| Airport Lounge Access | Available at 1300+ airports abroad with quarterly spend criteria | ❌ |

| Offers and Rewards | Earn Niyo Coins on card spends, referrals, and in-app purchases | ❌ |

| ATM Withdrawals Abroad | ✔️ | ✔️ |

| Customer Support | 24/7 in-app live chat | Varies with forex cards |

You can connect with us 24/7 via in-app live chat support or the bank help centres:

| Detail | SBM Bank | DCB Bank |

|---|---|---|

| Help Center Number | 1800 1033 817 | 022 6899 7777 | 040 6815 7777 |

| Niyo Email ID | global@goniyo.com | niyoglobal@dcbbank.com |

| Bank Email ID | customercare@sbmbank.co.in | customercare@dcbbank.com |

Security • Banking • Payments