Guide to Choosing Indian Credit Cards for Lounge Access

How to Choose the Best Indian Credit Card for Airport Lounge Access

In this guide, we will explore the world of credit cards with airport lounge access and provide you with valuable insights to help you choose the best Indian credit card for airport lounge access. So, let’s dive in!

Things to Consider When Choosing Indian Credit Cards for Lounge Access

If you have been wondering which Indian credit card is best for airport lounge access, here are the things you should consider first.

1. Number of Lounge Visits

When it comes to choosing the best credit card for airport lounge access, one of the key factors to consider is the number of lounge visits offered. Some credit cards provide unlimited access to lounges, while others have a limited number of visits per year. To determine which option suits you best, consider how often you travel and the duration of your trips. Frequent travellers who spend a significant amount of time at airports may benefit from a card with unlimited access, while occasional flyers might find a card with a smaller number of visits more suitable.

2. Terms and Conditions

Before jumping into the realm of credit cards with airport lounge access, it is essential to review the associated terms and conditions carefully. Pay close attention to factors such as lounge access limitations, fee structures, additional travel benefits, and expiry and redemption policies. These details can greatly impact your overall experience with the credit card and determine whether it aligns with your specific needs.

3. International or Domestic

Consider whether you primarily travel internationally or domestically when selecting an airport lounge access credit card. Different cards cater to different types of travellers, so it is crucial to choose one that aligns with your travel patterns. If you frequently embark on international trips, opt for a card that provides complimentary access to international lounges. On the other hand, if domestic travel is more common for you, look for a card that offers perks for accessing lounges within India.

4. Partnerships

Partnerships play a significant role in determining which lounges you can access with your credit card. When choosing a credit card, consider the partnerships it has with airlines and lounge programs. Ensure that the airports and lounges you frequent are included in the card’s network to maximise your lounge access benefits.

5. Shopping Benefits

In addition to lounge access, many airport credit cards offer a range of other benefits geared towards frequent travellers. These benefits can include free international and domestic lounge visits, discounted flight bookings, travel insurance coverage, concierge services, and much more. When comparing credit cards, pay attention to these additional perks as they can enhance your overall travel experience and provide added value.

Don’t miss out on luxury travel perks! Get your free airport lounge card today!

Tips to Choose the Best Airport Lounge Access Credit Card

Here are some additional tips to help you choose the best Indian credit card for airport lounge access:

- Evaluate Lounge Network: Look for a credit card with an extensive network of airport lounges, ensuring access to lounges in destinations you frequently visit.

- Check Guest Access: Consider whether the card offers guest access, allowing your travel companions to enjoy the comforts of airport lounges alongside you.

- Review Additional Benefits: Beyond lounge access, prioritise cards that offer extra perks such as travel insurance, concierge services, or discounts on flights and hotel bookings.

- Compare Annual Fees: While considering the benefits offered by a credit card, weigh them against the annual fees. Some cards may have higher fees but provide excellent value through their benefits.

- Understand Eligibility Criteria: Ensure that you meet the eligibility criteria for the credit card. Factors such as income, credit score, and existing banking relationships may influence your eligibility.

Introducing Niyo Card

Now that we’ve explored the key factors to consider when choosing an airport lounge access credit card, let’s introduce you to the Niyo Card - your ultimate travel buddy. If you are looking for a credit card with lounge access and no annual fee, the Niyo Card is a revolutionary travel companion that offers a plethora of benefits to enhance your international travel experience:

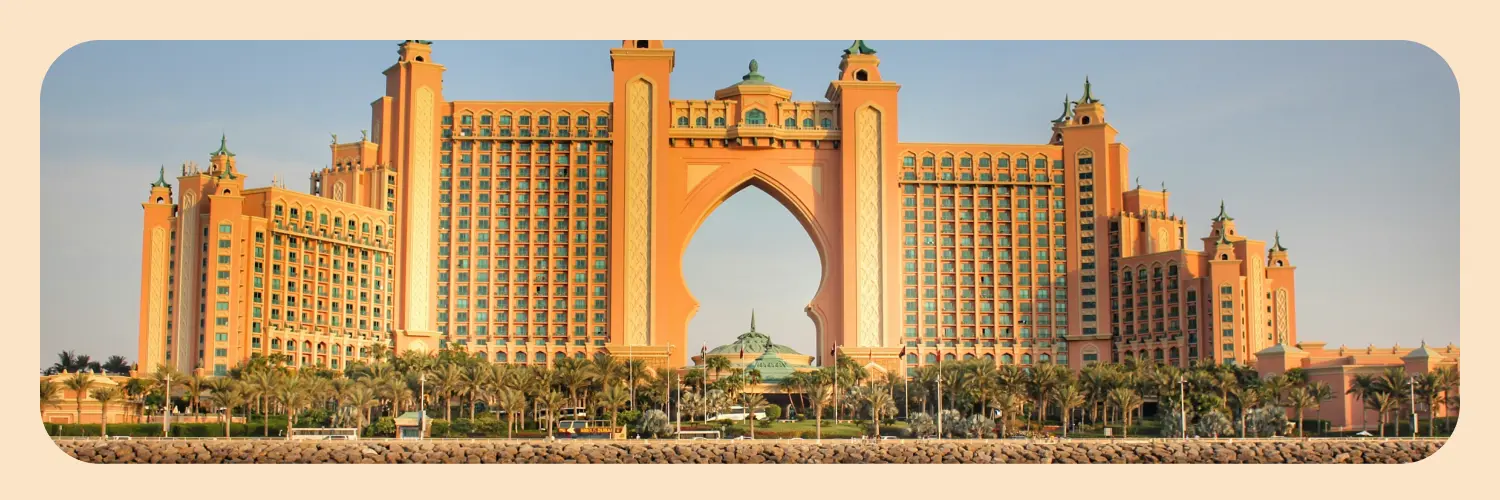

- Complimentary Airport Lounge Access: As a bonus, the Niyo Card provides complimentary airport lounge access in international terminals out of India for Niyo users when you spend INR 50,000 outside India in a calendar quarter using a single Niyo card.

A few things to remember:

- The Lounge Pass is accessible only for lounges outside India.

- The Lounge Pass is valid for 30 days from the date of generation.

- The total spend of ₹50,000 must be made using a single Niyo card. Combined spending across multiple Niyo cards will not be considered. - Zero Forex Markup: The Niyo Card charges no forex fees when converting INR into the currencies of 180+ countries, saving you from excessive foreign exchange charges.

- Free Loading and Unloading: There are no additional charges for loading INR onto the card or unloading it. You can use the card for as long as you want, as it comes with a lifetime validity.

- Up to 6.5% Annual Interest: The amount you don’t spend on your travels earns up to 6.5% annual interest with monthly payouts, ensuring your money works for you even while you’re away.

- In-app Currency Converter: The Niyo Global Card’s user-friendly app features a real-time currency converter, eliminating any surprises when making purchases abroad.

- Load in INR and Spend in 150+ currencies: You can load the Niyo Global card with INR before your trip or while you’re already abroad. With broad acceptance across more than 150+ currencies, it simplifies your international transactions.

- Tap and Pay: Enjoy the convenience of contactless payments with the Niyo Card. Simply tap and pay for your purchases, resulting in faster transactions and lesser wait times at checkout.

Key Takeaways

- Choosing the best Indian credit card for airport lounge access involves considering factors such as lounge visits, terms and conditions, international or domestic travel frequency, partnerships, and shopping benefits.

- Look beyond lounge access and compare additional benefits and annual fees among different credit cards.

- The Niyo Global Card offers comprehensive features like zero forex markup, free loading and unloading, annual interest on unused funds, in-app currency conversion, broad acceptance, tap-and-pay convenience, complimentary airport lounge access, etc.

With this comprehensive guide at your disposal, you are now equipped to choose the best Indian credit card for airport lounge access. Make an informed decision and elevate your travel experiences with the right credit card by your side.

Download the Niyo app today for a hassle-free travel experience tailored to your needs.

![Cover image for post: Best Business Class Lounges in the World [Latest Guide]](/blog/best-business-class-lounges-world/images/Banner-image-for-best-bussiness-class-lounges.webp)