Cards with International Lounge Access: Guide for Indians

List Of Requirements For Cards That Offer International Lounge Access

share

![]()

The Essence of International Lounge Access

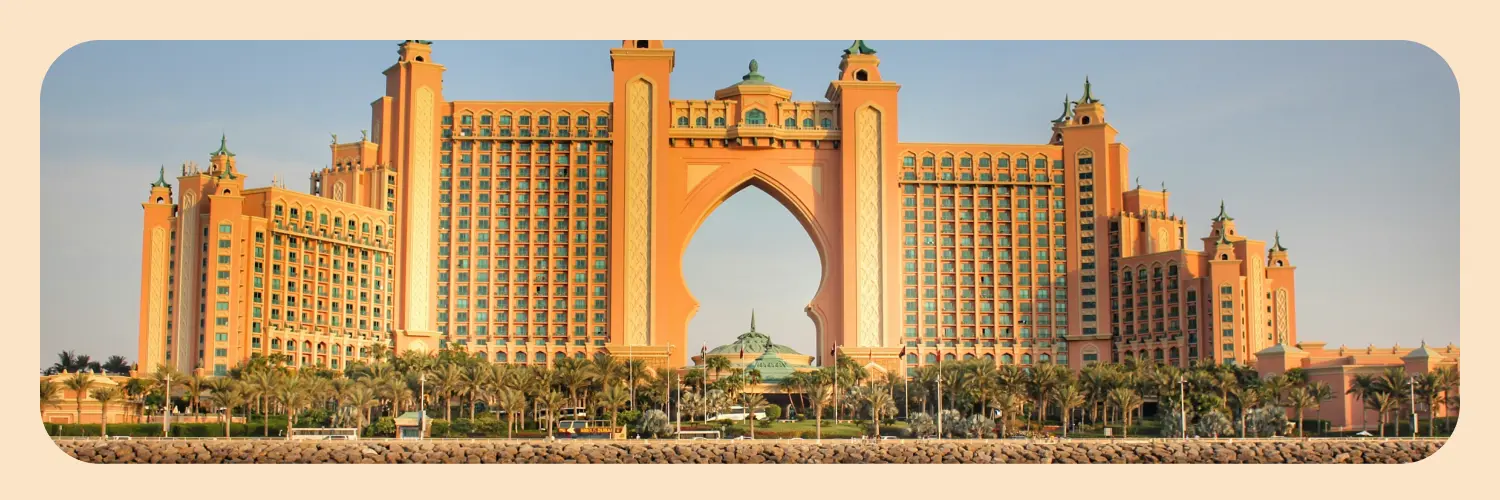

Airport lounges represent an oasis of calm and luxury in the midst of the chaotic airport environment, offering travellers a unique blend of comfort, convenience, and exclusivity. With cards with international lounge access, passengers can enjoy a plethora of amenities designed to elevate their travel experience.

These sanctuaries provide not just comfortable seating but also offer an array of complimentary services such as high-speed Wi-Fi, gourmet dining options, refreshing showers, and sometimes even private sleeping areas.

For business travellers, lounges serve as impromptu offices equipped with quiet workspaces. The essence of lounge access lies in its ability to transform waiting time into a valuable and enjoyable part of the journey, making it a highly sought-after benefit for any traveller looking to enhance their travel experience.

Criteria for Cards with International Lounge Access

Securing cards with international lounge access typically involves meeting a set of criteria set forth by credit card issuers. These criteria often include a robust credit score, demonstrating financial reliability and the ability to manage credit wisely. Issuers may also assess your annual income and spending habits to ensure they align with the premium nature of the card.

While many cards with international lounge access come with an annual fee, reflecting the value of the perks they offer, there are select cards in the market that balance benefits with cost, such as a credit card with international lounge access and no annual fee. It’s important to weigh the cost against the benefits, as cards with higher fees often provide broader lounge access and additional travel perks.

When evaluating options, consider not only the immediate access to luxury lounges but also the long-term value of the card’s rewards structure, travel insurance, and other travel-related benefits that can enhance your overall travel experience.

Choosing the Right Card

When searching for the best credit card with international lounge access, it’s crucial to consider not just the lounge access itself, but also other card features such as annual fees, reward rates, and additional travel benefits. For those seeking to avoid yearly charges, a free credit card with international lounge access might be appealing, though the benefits might be more limited.

For travellers prioritising lounge access without the burden of fees, the credit card with free international lounge access emerges as an attractive option. These cards balance the luxury of lounge access with the practicality of no annual fees, offering a sweet spot for savvy travellers.

Niyo: A New Era of Lounge Access

In the realm of travel convenience, Niyo Global is revolutionising how travellers access airport lounges. Unlike traditional cards with international lounge access, Niyo’s Forex Card for travellers offers a unique approach.

With the Niyo App, users can easily locate lounges and secure access through a simple QR Code scan via the “Lounge Pass” feature.

This innovative method provides one complimentary airport lounge access per quarter per user. Starting 1st April 2024, you can enjoy one complimentary Lounge Pass outside India per quarter when you spend INR 50,000 outside India in a calendar quarter using a single Niyo card. You can pick from any of the 1300+ international airport lounges outside India. The convenience and ease of the Niyo app make it an exceptional tool for modern travellers.

A few things to remember:

The Lounge Pass is accessible only for lounges outside India.

The Lounge Pass is valid for 30 days from the date of generation.

The total spend of ₹50,000 must be made using a single Niyo card. Combined spending across multiple Niyo cards will not be considered.

This digital innovation not only enhances the user experience but also aligns with the modern traveller’s expectation for quick, efficient, and seamless travel solutions. As we embrace this digital transformation, the convenience of accessing luxurious lounges through apps like Niyo is set to become the new standard in travel luxury, making it an indispensable tool for the savvy traveller.

Maximising Your Lounge Experience

To truly maximise the benefits of your credit cards with international lounge access, it’s crucial to familiarise yourself with the specific lounges available through your card and understand any restrictions or policies. Knowing the locations, amenities, and access hours of participating lounges can significantly enhance your pre-flight experience.

Additionally, be mindful of any guest policies, as some cards may allow you to bring guests for free, while others may require a fee. Staying informed about the number of complimentary visits and any additional costs for extra visits is also important to avoid unexpected charges.

Leveraging apps or membership portals that come with your card can help manage and track your lounge access benefits efficiently, ensuring you make the most of every travel opportunity.

Conclusion

In summary, while there are numerous cards with international lounge access available in the market, the unique approach of Niyo stands out for its convenience and innovation. By integrating lounge access with their app and Forex Card, Niyo offers a seamless travel experience that caters to the modern traveller’s needs.

Whether you’re a family looking for a quiet space before your flight or a solo traveller seeking a moment of luxury, Niyo’s lounge access feature provides a compelling solution without the need for a traditional credit card.

Embrace the Niyo way, and transform your travel experiences into journeys of comfort and luxury.

![Cover image for post: Best Business Class Lounges in the World [Latest Guide]](/blog/best-business-class-lounges-world/images/Banner-image-for-best-bussiness-class-lounges.webp)