Niyo Card: Enjoy International Lounge Access and Savings

Skip the fees and keep the comfort. The Niyo Card brings you global perks without the financial fuss.

Eligibility Criteria for Free Airport Lounge Access with a Niyo Card

Starting 1st April 2024, you can enjoy one complimentary Lounge Pass outside India per quarter when you spend INR 50,000 outside India in a calendar quarter using a single Niyo card. You can pick from any of the 1300+ international airport lounges outside India.

A few things to remember:

The Lounge Pass is accessible only for lounges outside India.

The Lounge Pass is valid for 30 days from the date of generation.

The total spend of ₹50,000 must be made using a single Niyo card. Combined spending across multiple Niyo cards will not be considered.

Unlocking Lounge Access Benefits with the Niyo Card

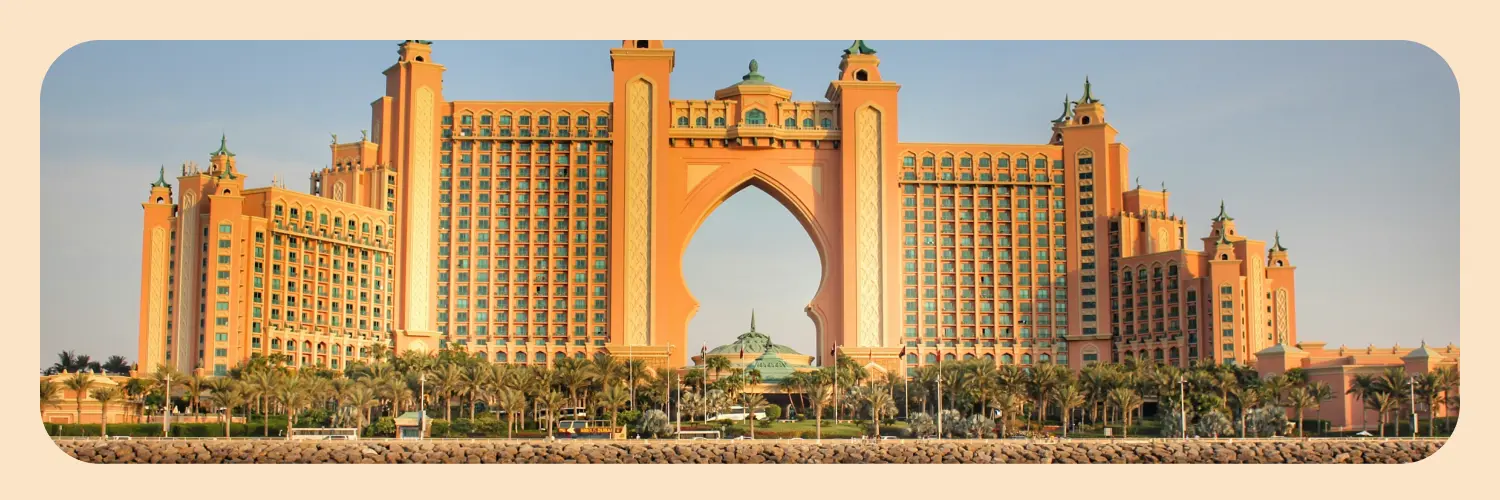

Have you ever found yourself waiting for hours at an airport during a layover? Long flights can be exhausting, and having access to a comfortable lounge can make all the difference in your travel experience.

With the Niyo app, you can enjoy international lounge access 1300+ airport lounges worldwide. Whether it’s a complimentary meal, cosy seating, or high-speed Wi-Fi, these lounges provide a sanctuary amidst the chaos of travel.

But what about the cost? Thankfully, Niyo’s partnership with various airport lounges allows you to access them for free or at heavily discounted rates. You can locate these lounges using the lounge locator feature on the app. Every quarter, you can cherish one free lounge access facility at any lounge worldwide packed with amenities.

Benefits Beyond Lounge Access

While lounge access is undoubtedly a fantastic perk of the Niyo Card, its benefits extend far beyond that. Let’s take a closer look at some other noteworthy features:

- Zero TCS on Spends: One of the most significant advantages of using the Niyo Card is that you won’t have to worry about Tax Collected at Source (TCS) when making international transactions. This means more savings in your pocket!

- Broad Acceptance: With broad acceptance in over 180 countries, the Niyo Global Card eliminates the need for multiple currency conversions. You can use it to make everyday transactions at points of sale and ATMs without any hassle.

- Travel Mode on the Niyo App: The Niyo app is designed to be your ultimate travel companion. In addition to managing your money and tracking your expenses, the app also offers a convenient Travel Mode. This mode allows you to apply for visas, transfer money internationally, exchange currency, and even withdraw local cash – all in one place.

Saving Money with Zero Forex Markup

Foreign currency exchange rates can sometimes be steep, eating into your hard-earned savings. However, with the Niyo Card, you can say goodbye to high forex markups. Unlike traditional credit or debit cards, the Niyo Card offers zero forex markup, ensuring that you get the most out of your money.

To put this into perspective, let’s consider an example. Suppose you’re studying in the United States and need to make a purchase worth $1,000. With a traditional credit card charging a 3% forex markup, you would end up paying $30 extra.

However, with the Niyo Card, you’ll save that $30 and have it available for other important expenses during your study abroad journey. You can get an even bigger saving if you use the Niyo app and scan a QR code to get your work done in a jiffy.

Cashback Rewards on Domestic Spends

Managing your finances abroad involves a delicate balance between spending and saving. To sweeten the deal even further, the Niyo Card also offers up to 1% cashback on eligible domestic spends.

This means that every time you use your card for day-to-day expenses like groceries, dining out, or shopping, you’ll earn cashback rewards that can be redeemed for future purchases.

Tips for Maximising Your Niyo Card Experience

Now that you’re familiar with the must-know features of the Niyo Card with international lounge access let’s dive into some practical tips to help you make the most out of this valuable financial tool:

- Use the ‘Notify Me’ Feature: The Niyo app allows you to set up real-time transaction alerts through its ‘Notify Me’ feature. This ensures that you stay updated on every transaction made using your Niyo Card and adds an extra layer of security.

- Plan Ahead for Lounge Access: While the Niyo Card provides access to a wide range of lounges, it’s always a good idea to check the availability and specific requirements for each airport before your trip. This will help you plan your layovers effectively and ensure a seamless travel experience.

- Reload Instantly: With the Niyo app, you can easily reload your Forex card instantly, eliminating the need to carry large amounts of cash. This not only enhances convenience but also ensures the safety of your funds while travelling.

Key Takeaways

- The Niyo Card offers international lounge access at over 1300 airports worldwide, providing comfort and convenience during layovers.

- The card comes with additional benefits such as zero TCS on spends, broad acceptance in over 180 countries, and the Travel Mode on the Niyo app.

- By using the Niyo Card, you can save money with zero forex markup on international transactions.

- Domestic spends made with the Niyo Card also earn up to 1% cashback rewards.

From saving money on forex markups to enjoying comfortable lounges during travel, the Niyo card is designed to enhance convenience and provide peace of mind. So why wait? Download the Niyo app today and embark on your international education journey with confidence!

![Cover image for post: Best Business Class Lounges in the World [Latest Guide]](/blog/best-business-class-lounges-world/images/Banner-image-for-best-bussiness-class-lounges.webp)