Future of a Convenient Online Banking System | Neo Banking

Experience Online Banking With Neo Banking

Personalized financial insights, budgeting tools and integration with services are becoming increasingly crucial. These features enable users to have control over their finances and achieve their goals. To thrive in this landscape of online banking platforms, future of banking needs to prioritize innovation, user design and unwavering commitment to security. This ensures that customers have a seamless and empowering experience.

Introduction to Neo Banking:

Thanks to the global technological advancement of the online banking industry, the future of digital banking or e-banking looks promising across all sectors, from personal banking, virtual bank account to corporate banking. Not more than a decade ago, people used to stand in lines to transfer and withdraw money at banks. Today, it takes only a few seconds to do online banking transactions from the bank’s mobile app via digital banking. Technology and the internet have truly revolutionized banking for future generations to come. But what is neo banking?

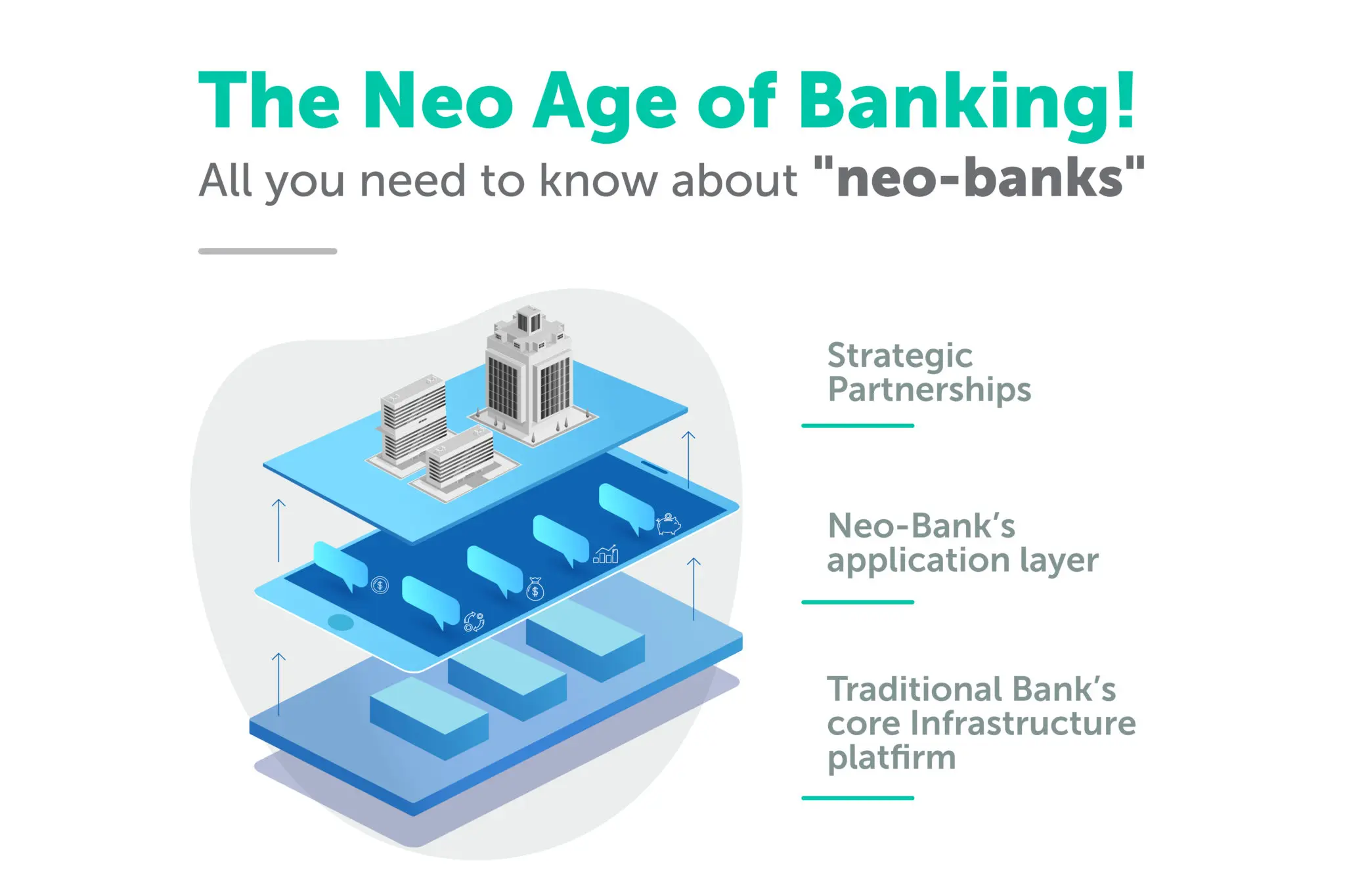

The first wave of the fintech revolution was led by startups focusing on digital banking, payments and lending. Now it’s “Neo-Banks” that are grabbing the attention of both fintech investors and entrepreneurs, with venture capital investments in neo-banks leading the charts of all fintech investments and a number of neo-banks emerging both globally and in India. That being said, there is a fair amount of skepticism within the analyst and banker communities and the common public that ‘neo-banking’ may just be a fad that will taper down with time. But in reality, neo-banks are here to stay, and they are surely a prominent part of the future of banking.

Difference between Neo Banking & Other Online Banking Processes:

In comparison to traditional banking, Neo Bank is completely operated online without the hassle of being physically present for any transaction or process. While in usual banking, a virtual bank account or an online account is an online subsidiary of an existing bank that offers digital bank account service.

How Neo Banking could be the future of online banking:

Here are 5 reasons why neo-banking is likely to become the next big online banking thing in the world of e-banking.

1. Neo-Banking: Class apart UI/UX

It’s tempting to see neo-banks as mere cosmetic upgrades on e-banking, with a shiny UI/UX wrapped around the same old financial products. While customer experience and design are certainly key, successful neo-banks go far beyond a pretty interface. They are at the forefront of product and business model innovation, offering a unique blend of financial services and non-financial value-added features.

Here’s how neo-banks stand out:

Product and Business Model Innovation:

Tailored Products: Neo-banks design products specifically for their target audience, whether it’s millennials, freelancers, or small businesses. This often involves creating innovative products that address pain points traditional banks haven’t tackled.

Open APIs: Neo-banks often leverage open APIs to integrate with third-party services, creating a more holistic financial ecosystem for their users. Other value added services include, Global ATM locator and Real-time currency converter.

Neo-banks are reimagining digital banking, offering more than just finance – they’re empowering individuals to thrive.

2. Neo-banks put the customer at the centre of everything.

Customers today demand a personalized and convenient banking experience. Neo-banks answer this call, offering a truly customer-centric approach built on:

- Tailored Solutions: Products and services designed for all customer segments.

- Personalized Finance Tools: Budgeting, spending tracking, and goal-setting tools to empower financial control.

- Seamless Digital Experience: User-friendly apps with easy account opening, quick transactions, and customer support.

- Security First: Cutting-edge security technologies for data protection and secure transactions.

3. A scalable, flexible, platform-based business model

Rapidly growing businesses often need a banking solution that grows with them. That is why they are always looking for e-banking solutions that can facilitate the services to cater to their needs. Traditional banking is designed to scale at a slower pace and can hinder the growth of businesses. Neo-banking offers the right scalable banking solutions to growing companies so they don’t have to compromise their growth.

Neo-banks, by design, are made for banking for the future. They have built their technology stack and business models in a way that is scalable, flexible and not segregated into silos. This frees neo-banks from many of the constraints large traditional banks face, enabling them to adapt rapidly in response to changing business landscapes and evolving customer expectations.

4. Collaborate instead of competing

Banks and fintech have had a tricky relationship over the years from competing for the same consumers. However, when we imagine online banking for the future, it has to be a synergy between the robust traditional banks with the rapidly advancing fin-tech brands and neo-banking. In recent times, both banks and platform-based fintech’s, particularly neo-banks have realized the mutual benefits of collaborating by leveraging each other’s strengths. Neo-banks present the financial services ecosystem–made up of traditional banks, non-bank lenders (NBFCs) and insurers–with an exciting proposition for inorganic growth through partnerships.

It allows the incumbent players to reap the benefits of product innovation, digital transformation and incremental revenue without the need for large investments or acquisitions. At the same time, neo-banks can gain access to capital and larger captive customer bases. A report by Morgan Stanley found that only about 7% of banks were involved in the development of in-house technology solutions. The majority of banks, instead, saw more value in either partnering or investing in fintech companies in the form of neo-banks.

5. Not a zero-sum game

While it is true that neo-banks are aiming to snatch market share away from traditional banks in certain customer segments and business verticals, they are also expanding the size of the pie itself by bringing in newer customer segments and enabling new use cases. This means the neo-banks are not only revolutionizing the existing banking services, but they are also paving the foundation for the future of banking.

For instance, the DCB Niyo Global Card is a prime example of neo-banking. It primarily aims to replace forex in the forms of hard currency or traveler’s cheque that Indians have traditionally used to spend during their foreign trips by digitizing the cross-border payments ecosystem.

While people are certainly turning to neo-banks to help them save, avoid fees and enjoy quick and simple banking, perhaps there’s enough room for both traditional and challenger banks to evolve banking for the future by collaborating with one another and complementing each other’s strengths. Neo-banking will surely change how people do banking in the future.

Frequently Asked Questions

1. How do neo-banks work?

Unlike traditional online bank accounts, neo-banks work entirely online. They do not have physical locations. Though neo-banks can facilitate easier and hassle-free baking solutions, they currently rely on traditionally recognized banks to operate. These banks offer a wide range of digital banking solutions. Once you open a digital account, you can perform various financial transactions with your traditional bank and many other value-added services.

2. What is the difference between a neo-bank and a digital bank account?

Though the terms neobank and digital bank account are often used interchangeably, the two have specific differences. Digital banks are often the online subsidiaries of an existing, well-established bank that offer online services. On the other hand, neobanks have no physical presence and solely exist online. That means, unlike the digital bank, neobanks do not have physical operations in banking locations; they are entirely online.