The Evolution Of Banking In India | Niyo

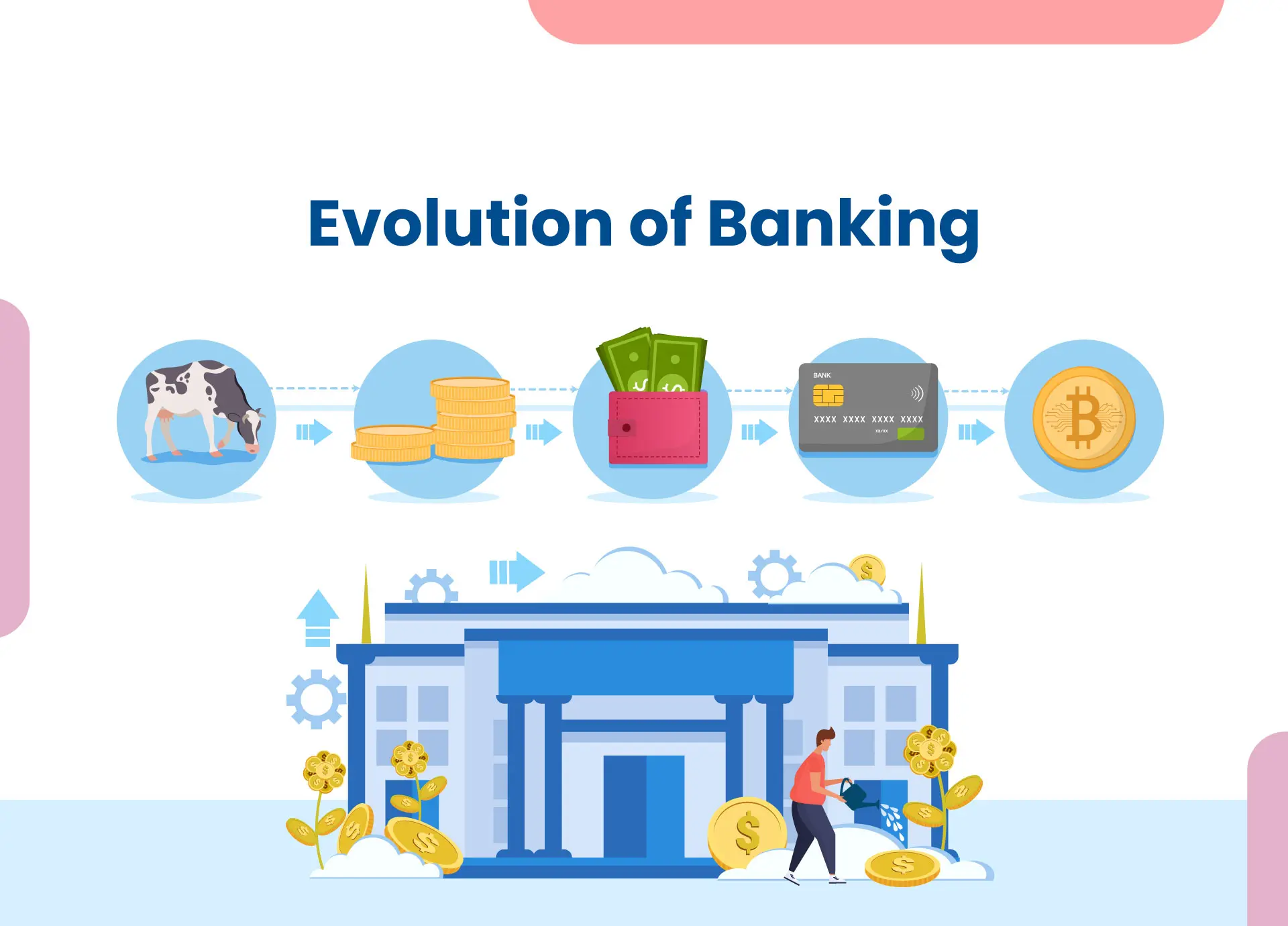

This blog explores the evolution of banking in India, starting from the establishment of early banks in the 18th century to the rise of digital banking today. It highlights key phases such as nationalisation, liberalisation, and the role of technology in transforming the financial landscape of the country.

Banking has existed for centuries, dating back to the days of civilization. The banking system in India has also transformed over time. Before diving into the evolution of banking in India, let’s look at how banking developed. Here’s a video that provides insights into the history of banking in India, highlighting traditions and mythical anecdotes that pay homage to our ancestor’s curiosity and imagination.

A country’s banking system plays a crucial role in its economic growth. With changes in people’s economic situations, the demand for financial services, and technological progress, India’s banking sector has significantly changed over the last five centuries. Let’s explore the evolution of the banking system in India and understand the country’s various types of banking systems.

It’s interesting to track the history of banking in India.

A country’s banking system plays a crucial role in its economic growth. With changes in people’s economic situations, the demand for financial services, and technological progress, Let’s explore the evolution of banking in India, starting from the establishment of the first bank to the current era of mobile banking. The history of banking in India can be divided into different phases.

Pre-independence Phase (1770-1947)

Post-independence Phase (1947-till date): To understand this phase better, we’ll break it down further into:

Pre-nationalisation Phase (1947-1969)

Post-nationalisation Phase (1969-1991)

Liberalization Phase (1991-till date)

Let’s deep dive into each one of these eras.

The Pre-Independence Phase (1770-1947)

The organised banking sector in India started over a hundred years before independence with the establishment of the Bank of Hindustan in 1770, located in the then-Indian capital, Calcutta. However, it faced failure and was liquidated in 1832. Other banks like the General Bank of India (1786-1791) and the Oudh Commercial Bank (1881-1958) were also established during the pre-independence era but didn’t endure for long. This marks the early stages of evolution of the banking system in India.

In the early to mid-1800s, the East India Company set up the Bank of Bengal, Bank of Bombay, and Bank of Madras, collectively called the Presidential Banks. In 1921, these three banks merged to create the Imperial Bank of India. This bank was then nationalized in 1955 and became the State Bank of India (SBI). By 1959, the SBI took control of 7 subsidiary banks, solidifying its position as India’s largest Public Sector Bank (PSB). This step marked a significant development in the evolution of the banking system in Indian.

Around 600 banks were established during this time. However, numerous major banks faced challenges and failed due to inadequate management skills, lack of machinery and technology, resulting in time-consuming processes and human errors. This made Indian account holders vulnerable to fraud. Despite these challenges, a few banks managed to survive the test of time and continue to exist today.

Between 1906 and 1911, influenced by the Swadeshi movement, local businessmen and political figures started banks for the Indian community, and some of them are still running today.

From the First World War (1914-1918) to the end of the Second World War (1939-1945), and two years after until India gained independence, the banking system faced challenging times, resulting in the failure of many banks.

The Post-Independence Phase (1947-1991)

This is a crucial phase in the history of banking in India. After gaining independence, the evolution of banking in Indian persisted as the Government of India (GOI) embraced a mixed economy approach in 1948, involving significant intervention in markets to bolster the economy. The Reserve Bank of India, established in 1935, was nationalized in 1949, granting it the authority to regulate, control, and inspect all banks in India.

Nationalization In 1969

In the 1960s, the RBI emerged as a major employer, and the Indian banking sector became instrumental in economic development. Despite this, apart from SBI, most banks remained under private ownership.

In a significant move in 1969, the Government of India issued the Banking Companies (Acquisition and Transfer of Undertakings) Ordinance. This decision resulted in the nationalization of the 14 largest commercial banks in India at that time, bringing forth various benefits of nationalization.

Nationalization In 1980

In 1980, a second wave of nationalization occurred, bringing six additional commercial banks into the fold. This event subsequently became a crucial part of the history of banking in India.

Reasons For Nationalization Of Banks In India

The nationalization of Indian banks marked a significant milestone in the evolution of the country’s banking industry. It had a profound impact on the operations of different types of banks in India. To grasp the influence it had and how it played a pivotal role in shaping the industry, let’s explore the circumstances that led to it. This move was driven by a crucial need, and it brought forth various benefits of nationalization.

Promote the economic development of the country

Develop confidence in the banking system of India

Prevent the concentration of economic power in the hands of a select few

Improve the efficiency of the banking industry

Create a socio-economic balance

Mobilize the national savings and channel them into productive purposes

Sectors such as exports, agriculture, and small-scale industries were lagging behind

Serve the large masses of the rural population.

Positive Impacts Of Nationalization

The nationalisation of banks marked a moment in the evolution of banking in India, greatly influencing its trajectory going forward. This measure, important in areas where access to major banks was limited, acted as a landmark towards achieving financial well-being. The nationalised banks played a role in improving the effectiveness of the banking system and fostering trust among individuals.

This move also significantly boosted lagging sectors like small industries and agriculture. The nationalised banks contributed to raising funds, leading to substantial economic growth. Following nationalization, different types of banks were established in India. Currently, there are 12 nationalized banks in the country. Let’s explore a few Benefits of Nationalization that have made a positive difference in the evolution of banking in India.

Better outreach: The penetration of banks increased when branches were opened in the remotest corners of the country.

Increased savings: With the opening of new branches, since more people had access to banks, the average domestic savings increased twofold.

Surged public deposits: Banks’ increased reach helped small industries, agriculture, and the export sector grow, leading to a proportionate increase in public deposits.

Increased efficiency: The added accountability led to improved efficiency and increased public confidence

Empowered small-scale industries (SSIs): The SSIs received a boost resulting in considerable economic growth.

Provided employment opportunities: RBI, post its nationalization, had already set a precedent of becoming one of the largest employers. This continued, with more banks following the lead.

Improved agricultural sector: Marginal farmers could receive credit from banks at economic rates, which gave a massive boost to India’s agricultural sector

Liberalisation In 1991

In 1991, the Government of India made significant changes in its economic policies by adopting economic liberalisation. This shift aimed to increase the involvement of private and international investments. As a result, the RBI approved the establishment of 10 private banks in India.

In a few years, Kotak Mahindra Bank (2001), Yes Bank (2004), IDFC (2015), and Bandhan (2015) banks joined the league.

Positive Impacts Of Liberalisation

Here’s how liberalisation revolutionised the Indian banking picture:

Revitalization of the Banking Sector: This resulted in rapid and robust growth for government, foreign, and private banks in India.

Adoption of Modern and Tech-Based Approaches: Traditional banks embraced modern and technology-driven methods.

Introduction of Payments Banks: A new category of banks, Payments banks, was established.

Creation of Small Finance Banks: The emergence of small finance banks became a notable development.

Normalization of Digital Transactions: The norm shifted towards the digitalization of bank transactions and operations.

Expansion of Foreign Banks: International banks like Bank of America, Citibank, HSBC, etc., established branches in India, bringing the total to 46.

Pause in Nationalization: Instead of further nationalization, the Indian banking sector experienced several mergers among public sector banks in the subsequent years.

So far, we have discussed at length the evolution of banking system in Indian. To sum it up, your bank is bound to fall into one of the following categories. Let’s take a closer look at the key features of different types of banks in India:

Commercial Banks

Commercial banks in India aim to make profits by taking in deposits and providing loans. Regulated by the Banking Regulation Act of 1949, these banks collect deposits and lend money to individuals, companies, and governments. Commercial banks can be owned either by the government or private entities and are classified into four categories.

Public Sector Banks

The Government of India mostly owns these banks, and they operate under government guidance to assure customers that their money is secure. Public sector banks in India follow financial guidelines set by the government, and they typically charge lower fees for their services than private banks. These banks also introduce various financial schemes for the public’s benefit.

SBI, one of the largest public banks in India, gained significant financial strength through its merger with five associate banks, securing a spot among the top 50 banks globally. The government’s nationalisation of state banks further propelled the growth of public banks in India. Additionally, foreign banks in India have also played a role in shaping the banking landscape.

Private Sector Banks

The majority of the stock in these banks is owned by a private entity, individual, or group of people. The RBI sets the guiding rules for private sector banks, which are the same for all banks in India.

Private-sector banks are those in which private shareholders hold significant stakes or equity. All the banking rules and regulations established by the RBI apply to private-sector banks.

Regional Rural Banks

These special commercial banks provide loans at lower rates specifically for farming in rural areas to help boost the rural economy.

Foreign banks

These are banks from other countries that have their main offices outside India but operate branches within the country. They are commonly referred to as foreign banks in India.

Co-Operative Banks

Co-operative banks were created to help society by offering low-interest, short-term loans to agriculture and related industries. These banks operate cooperatively, meaning they belong to their members. This implies that the customers of a cooperative bank are also its owners. They can be divided into different categories.

Rural co-operative banks:

These banks primarily support agriculture-related activities, such as farming, dairy, and fish culture. Additionally, they provide funding for small-scale industries and self-employment activities.

Urban co-operative banks:

These banks finance people for self-employment, industries, small-scale units, and home finance.

Specialised Banks

From 1982 to 1990, the government set up various specialised banking institutions tailored for specific sectors such as agriculture, foreign trade, housing, and small-scale industries. This marked the beginning of the evolution of financial services in India, introducing notable institutions.

NABARD (National Bank for Agriculture and Rural Development,1982) to support agricultural activities

EXIM Bank (Export-Import Bank of India, 1982) to promote export and import

National Housing Bank (1988) to finance housing projects

SIDBI (Small Industries Development Bank of India, 1990) to fund small-scale industries

Now that we’ve discussed commercial banks let’s explore payment banks and the various types of banking systems in India.

Payments Banks

Payment banks are a newer type of bank introduced by the RBI in 2014 to operate on a smaller scale with minimal credit risk. Their main goal was to promote financial inclusion by providing banking and financial services to the unbanked or underbanked.

Payment banks have certain limitations—they can only accept deposits of up to ₹2 lakhs per customer and are not allowed to issue loans or credit cards. However, they can offer current and savings accounts, issue ATM and debit cards, and provide net banking and mobile banking services. The introduction of making online payments through mobile apps marked the evolution of e-banking in India.

Small Finance Banks

In 2016, the RBI approved the establishment of small finance banks to increase financial inclusion for those not served by traditional banks. These banks, with low-cost operations and modern technology, focus on providing savings facilities and credit to small businesses, small and marginal farmers, and micro and small industries.

Digital Banking In India

Digital banking refers to the convenience of conducting all banking activities such, as opening accounts transferring funds and making payments eliminating the need to physically visit a bank branch.

The introduction of the UPI (Unified Payment Interface) System and BHIM by the National Payments Corporation of India (NPCI) in 2016 sparked a revolution in banking. Thanks to advancements numerous fintech companies in India have collaborated with banks to enhance digital banking and offer a wide range of financial services. A recent proposal by Niti Aayog suggests the establishment of ‘digital banks that operate solely through the internet without any branches. This forward thinking initiative is expected to bring about a evolution of banking in india.

Key Takeaways

Banking in India has evolved over centuries, beginning with the Bank of Hindustan in 1770.

Major phases include the pre-independence era, nationalisation of banks in 1969 and 1980, and economic liberalisation in 1991.

Nationalisation expanded banking access across rural and underserved areas, promoting economic growth.

Liberalisation introduced private and foreign banks, boosting competition and innovation.

New-age institutions like payments banks and small finance banks have further improved financial inclusion.

Digital banking and UPI have revolutionised the way people manage money in India today.

Frequently Asked Questions

- Pre-nationalisation Phase (1947-1969)

- Post-nationalisation Phase (1969-1991)

- Liberalization Phase (1991-till date)

What is the importance of banking in India?

The banking system in India aims to offer confidence and security in the economy. The banking system manages the flow of money between businesses and people. Following are some of the major functions of the banking system in India.- Accept deposits of money.

- Provide money withdrawals

- Provide different types of banking accounts

- Offer different types of loans

- Support customers

- Offer Credit cards

- Offer Debit cards

- Provide Fund remittance

- Provide Bill payment facility

- Offer Internet banking

What are the five advantages of a bank?

A few of the advantages of banks are:- Security of money

- Inculcating a habit of saving money

- Ease of money transfer

- Ease of bill payments

- Ease of international transactions