Salary Calculator - Calculate Take Home Salary

What is Salary?

Salary is the fixed amount of money every professional employee gets for their work at the end of each month (don’t you eagerly look forward to this day each month?). The salary amount is usually mentioned in your offer letter or you can find it in your payslip as well.

Do you find your salary slip confusing? Allow us to break it down for you. Before we get started, here are a few salary-related terms you need to know:

CTC

CTC (Cost to Company) is your total salary package that includes all benefits spent on you by the company without any tax deductions.

Gross Salary

Gross salary is your salary before any deductions are made from it. Gross salary includes your basic salary, house rent allowance (HRA), provident fund, leave travel allowance (LTA), medical allowance, Professional Tax etc. Simply put,

Gross salary = CTC − Bonus

Gratuity

Gratuity is the monetary benefit given by your employer in return for your services. Eligibility to receive gratuity is dependent on the fact that you should have completed at least 5 years in an organisation. However, gratuity can be paid before 5 years in case of the death of an employee or they become disabled due to an accident or illness.

Components of your salary slip

Basic salary

It is the base amount of your salary package. It varies between 35-50% of your total gross salary depending on your designation, experience, and the industry you work in. The basic salary is fully taxable.

House Rent Allowance (HRA)

This is the benefit given towards expenses related to rented accommodation. It is a fully taxable component of your salary if you do not live in a rented house.

Leave Travel Allowance (LTA)

This is an allowance given by your employer for domestic travel while you are on leave and is exempt from income tax as per the Income Tax Act 1961.

Special Allowance

It’s a fixed amount given over and above your basic salary for meeting certain requirements and varies across companies. It is a fully taxable component of your salary.

Bonus

It’s a performance-based incentive given by your employer that’s part of your gross salary and fully taxable.

Employee contribution to the provident fund (EPF)

Both you and your employer each contribute 12% of your basic salary each month to the EPF (Employee Provident Fund). The contribution you make towards the EPF is eligible for a deduction under Section 80C of the Income Tax Act, 1961.

Professional tax

It’s a direct tax you need to pay to the state government and the maximum amount payable is ₹ 2,500 per year.

We hope the above breakdown of your salary components gave you sufficient information to get started. Calculating your in-hand salary can be quite tricky because of all the different components. If you’re still feeling confused, you’re not alone. Many folks rely on a salary calculator in India to overcome this hurdle.

What is a salary calculator?

An in-hand salary calculator is a nifty tool that’ll automatically calculate your take-home salary. It’s the total salary you’ll get after all the applicable deductions. The take home salary calculator includes a formula box, where you can enter your CTC and the bonus included in your CTC.

The monthly salary calculator will show you the deductions such as EPF contributions from you and your employer, Professional tax, Insurance, and the take-home salary.

The CTC to in-hand salary calculator takes away all the confusion around your salary. Try it to make your salary calculations easier.

Salary calculation formula

The salary calculations involve multiple components, so you need different formulas to calculate each aspect of your salary. Here are the most important formulas you must understand:

- Gross salary: CTC – EPF – Gratuity

- Gratuity: (Basic salary + DA) × 15/26 × Number of years you have worked for the company

- Taxable income: Gross Salary – EPF/PPF Contribution – Tax-free Allowance – HRA – LTA – Health Insurance – Tax-saving Investments – Other Deductions

- Take-home Salary (Net Salary Post Taxes): Gross Salary – Income Tax – EPF Contribution – Professional Tax

- Don’t want to memorize all these formulas? Try the salary calculator online to keep things simple.

How to calculate monthly take-home salary

Your monthly in-hand salary is the actual amount that remains after taking away all the deductions from your gross salary.

For instance, if your CTC is ₹7.5 lakhs and the company pays you ₹50,000 as a bonus each year, then your

Gross Salary = CTC – Bonus = ₹7.5 lakhs – ₹50,000 = ₹7 lakhs

To arrive at the total deductions in your salary:

- You need to deduct the yearly professional tax from the gross salary. The professional tax amount varies from state to state (we’ll assume it’s ₹2,400 in your state).

- You must deduct the total EPF contributions by you and your company. Your employer matches your EPF contribution. EPF contribution is calculated on a maximum salary limit of ₹15,000 per month. Your monthly EPF contribution = 12% of ₹15,000 = ₹1,800

Your yearly EPF contribution = ₹1,800 x 12 = ₹21,600

Your company’s yearly EPF contribution = ₹21,600

- Let’s assume your employee insurance deduction is ₹2,000 per year. Total deductions = Professional tax + EPF (your contribution) + EPF 9company contribution) + Employee insurance = ₹2,400 + ₹21,600 + ₹21,600 + ₹3,000 = ₹48,600.

Total yearly take-home salary = Gross salary – Total deductions = ₹7 lakhs – ₹48,600 = ₹6,42,400.

Monthly take-home salary = Annual salary/12 = ₹6,42,400/12 = ₹53,533.

Well, doing these calculations can be quite confusing. So, most people prefer using the PayScale Salary Calculator in India. The automated tool helps calculate your take-home salary in a matter of seconds without you having to do the math.

Difference between CTC and gross salary

CTC is the total amount a company spends for hiring and retaining you as their employee. It includes your salary along with all the benefits, including EPF, HRA, medical insurance, gratuity, and other allowances. CTC may also include cab service, subsidized loans, food coupons, and much more.

Depending on the benefits provided by a company, the CTC varies across companies and your take-home salary depends on your CTC.

Gross salary is the amount that remains after subtracting gratuity and EPF from the CTC. The gross salary is always higher than your take-home salary as the amount is calculated before deductions. It includes your bonus, overtime pay, and any other additional benefits offered by your company.

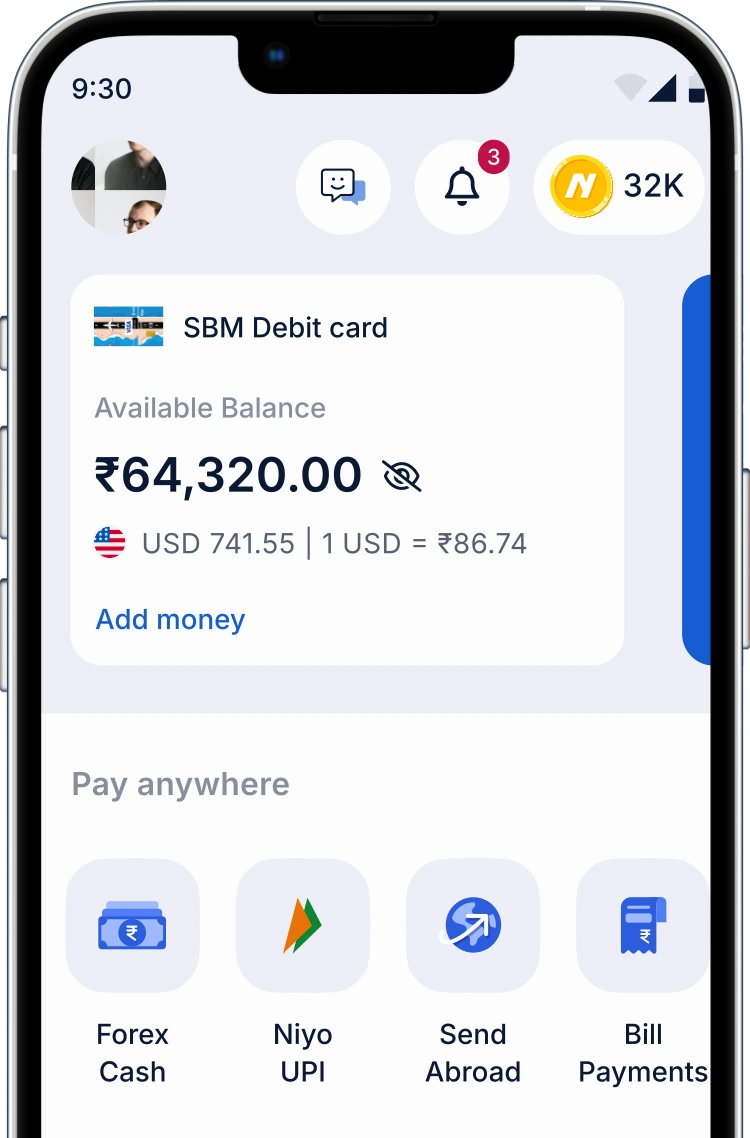

Looking for the best salary account? Get yourself the NiyoX digital savings account with perks like Salary Rewards* with monthly salary credit, a ZERO balance account, 7% interest* p.a., and many more compelling benefits you can’t resist.

Onboard NiyoX in less than 100 seconds!

Download NiyoX app from Google Play Store or iOs App Store now.

Frequently Asked Questions

Voluntary Provident Fund (VPF) is a provident fund scheme where you can contribute a desired portion of your salary towards your EPF account every month. This is a voluntary scheme and your employer is not bound to pay anything. This is in addition to your monthly 12% EPF contribution.

There’s no limit on how much you can contribute towards VPF. You’re free to contribute your entire basic salary as well as the DA.

A financial year (FY) is the period where income is earned, an assessment year (AY) is the following year where a tax evaluation is done for the income earned in the previous financial year. Since income can’t be taxed before it’s earned, the terms financial year and assessment year came into existence.

For instance, if you start earning in the year 2022, this year will be the financial year and 2023 when your actual tax will be calculated, will be known as the assessment year.

Take-home Salary = Gross Salary – Income Tax – Employee’s PF contribution (PF) – Professional Tax.

Gross Salary = CTC – Employer’s PF contribution (EPF) – Gratuity.

Gratuity = (Basic salary + DA) × 15/26 × No. of years of service.

Taxable Income = Gross Salary – Employee’s PF Contribution (PF)/PPF investment – Tax-free Allowance – HRA – LTA – Medical Insurance – Tax Saving Investments – Other Deductions.

There is no right answer to it. You should evaluate the benefits of the old tax regime and new tax regime before choosing the one that works better for you. Comparison of Taxes: Old Regime vs. New Regime

FY 2022-23

Annual Income Slab Old Regime

New Regime

Resident Individuals & HUF < 60 years of age & NRIs Resident Individuals & HUF > 60 to < 80 years Resident Individuals & HUF > 80 years Applicable for All Individuals & HUF Up to ₹2.5 lakhs Nil

Nil

From ₹2.5 – 3 lakhs 5%

Nil

5%

From ₹3 – 5 lakhs 5%

Nil

From ₹5 – 7.5 lakhs 20%

10% From ₹7.5 – 10 lakhs

15%

From ₹10 – 12.5 lakhs 30%

20%

From ₹12.5 – 15 lakhs 25%

Above ₹15 lakhs 30%

There are 70 deductions and exemptions that are not allowed in the new regime, out of which the most commonly used are listed below: Exemptions and deductions “not allowed” under new tax regime Deductions “allowed” under new tax regime Leave Travel Allowance (LTA) Transport allowance for specially abled people House Rent Allowance (HRA) Conveyance allowance Conveyance allowance for expenditure incurred for travelling to work Daily expenses in the course of employment Relocation allowance Investment in Notified Pension Scheme under section 80CCD(2) Helper allowance Children education allowance Deduction for employment of new employees under section 80JJAA Other special allowances [Section 10(14)] Standard deduction on salary Depreciation u/s 32 of the Income-tax act except additional depreciation. Professional tax Interest on housing loan (Section 24) Any allowance for travelling for employment or on transfer Deduction under Chapter VI-A deduction (80C,80D, 80E and so on) (Except Section 80CCD(2)) Does CTC include PF? CTC includes all costs incurred on an employee, including PF.

CTC = Gross Salary + PF + Gratuity