Send money globally

at zero forex markup

Fully digital, high-speed, and secure international money transfer for education abroad

Powered by

High-speed, zero-fee global transfers

How it works

Enter details

Add the recipient and amount for your international remittance

Upload documents

Provide supporting documents for seamless verification

Track transfer

Monitor your international money transfer online in real time

Money credited

Funds reach the recipient within 2–3 working days

Works with top currencies to send money abroad from India easily.

United States Dollar

United States Dollar British Pound Sterling

British Pound Sterling Canadian Dollar

Canadian Dollar Euro

Euro Hong Kong Dollars

Hong Kong Dollars Japanese Yen

Japanese Yen Australian Dollar

Australian Dollar Saudi Riyal

Saudi Riyal Singapore dollar

Singapore dollar South African Rand

South African Rand Swedish Krona

Swedish Krona Swiss Franc

Swiss Franc United Arab Emirates Dirham

United Arab Emirates Dirham New Zealand Dollar

New Zealand DollarTrusted by 1 million+ users in India for international money transfers

Frequently Asked Questions

Niyo makes international money transfers faster, more straightforward, and more cost-effective than traditional banks. Here’s how:

- Cheaper: No forex markup; you get real exchange rates.

- Safer: Your money is handled by RBI-regulated partners.

- Faster: Remittances usually arrive within 2–3 business days.

- Simpler: The process is entirely digital and app-based, with real-time tracking. Niyo is widely regarded as one of the best ways to send money internationally, particularly for students.

Currently, Niyo supports sending money abroad for education-related expenses such as:

- University tuition fees

- Student accommodation or rent

- Daily living expenses for international students This makes Niyo especially useful for families supporting students studying overseas.

Currently, only students and their close family members can use Niyo’s international money transfer service. Eligible family members include:

- Parents and grandparents

- Siblings and step-siblings

- Step-parents

- Spouse

The process is simple:

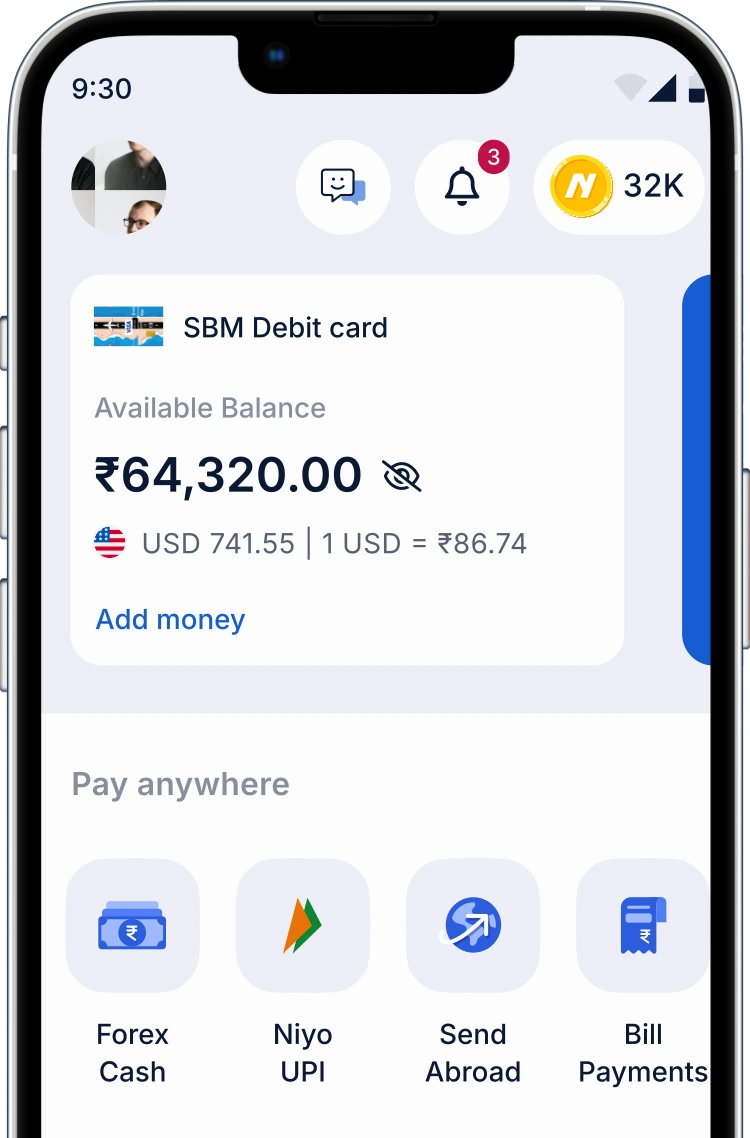

- Download and log in to the Niyo app.

- Select the remittance option and enter the recipient’s details.

- Upload required documents (e.g., passport, visa, university letter).

- Make payment via UPI or Internet banking.

- Track your international money transfer online in the app.

Niyo combines low cost, ease of use, and fast transfers:

- Real-time exchange rates with zero markup

- No hidden charges

- Fully digital and transparent process

- Customer support and document verification are built in These features make it one of the best ways to send money internationally, especially for students.